Table of Content

- What is a 12-month premium?

- Home and property insurance

- Average homeowners insurance rates by state by coverage level

- How much is homeowners insurance in California?

- Which state has the lowest homeowners insurance rates?

- Are State Farm auto policies 6 or 12 months?

- Average homeowners insurance cost by state

Its average annual rate is 61% higher than the national average home insurance cost. Based on Insurance.com’s rate analysis, on average the home insurance cost in Texas is $4,142. Texas is counted among the states with the highest homeowners insurance rates. Past claims history is one of the factors insurers use to set home insurance rates. In order to keep your rates low, you should consider paying for minor claims out of pocket.

You’ll need to maintain the amount of coverage required by your mortgage company, and being underinsured is risky. The easiest way to get cheaper home insurance is to shop around. You can also consider raising your deductible and looking for discounts. Nearly all states allow insurers to consider a person's credit history. For home insurance, value is the quality of the coverage you get for the money you spend. Considering the nature of the investment — one you hope you’ll never have to use — homeowners are especially, and rightly, conscious of what they pay.

What is a 12-month premium?

All coverages are subject to all policy provisions and applicable endorsements. 1 Customers may always choose to purchase only one policy, but the discount for two or more purchases of different lines of insurance will not then apply. Savings, discount names, percentages, availability and eligibility may vary by state. No matter the size of the operation, whether you own or rent, or raise crops or livestock, our policies may be expanded and tailored to help meet your unique insurance needs.

Allstate started as a subsidiary of Sears and Roebuck in 1931, selling insurance out of a mail-order catalog. At the end of the decade, this figure skyrocketed to over 100,000. The first Allstate agent sold insurance out of a booth at the 1933 Chicago World Fair, and there were soon thousands of more agents working out of Sears stores nationwide. When paying your State Farm bill at Money Services, bring along your State Farm bill stub, with the account number, and either the cash or your debit card to cover the payment fee.

Home and property insurance

Most home insurance policies come with $100,000 in personal liability insurance but this is rarely enough coverage. The cost to defend a lawsuit or to pay for medical expenses for a serious injury can easily exceed that amount. Most experts recommend upping your limits to at least $300,000. When buying homeowners insurance, you should get enough dwelling coverage to match the full replacement cost of your home. Although the national average rate for home insurance is $2,777, the cost varies by coverage levels and location. Homeowners insurance is most expensive in Oklahoma at $5,317 a year and cheapest in Hawaii at $582 a year.

It is one of the five states with the least expensive homeowners insurance. Location is one of the biggest factors in your home insurance rates. At $400,000 in coverage the highest annual average rate is $6,387 in Oklahoma and the lowest annual average rate is $749 in Hawaii.

Average homeowners insurance rates by state by coverage level

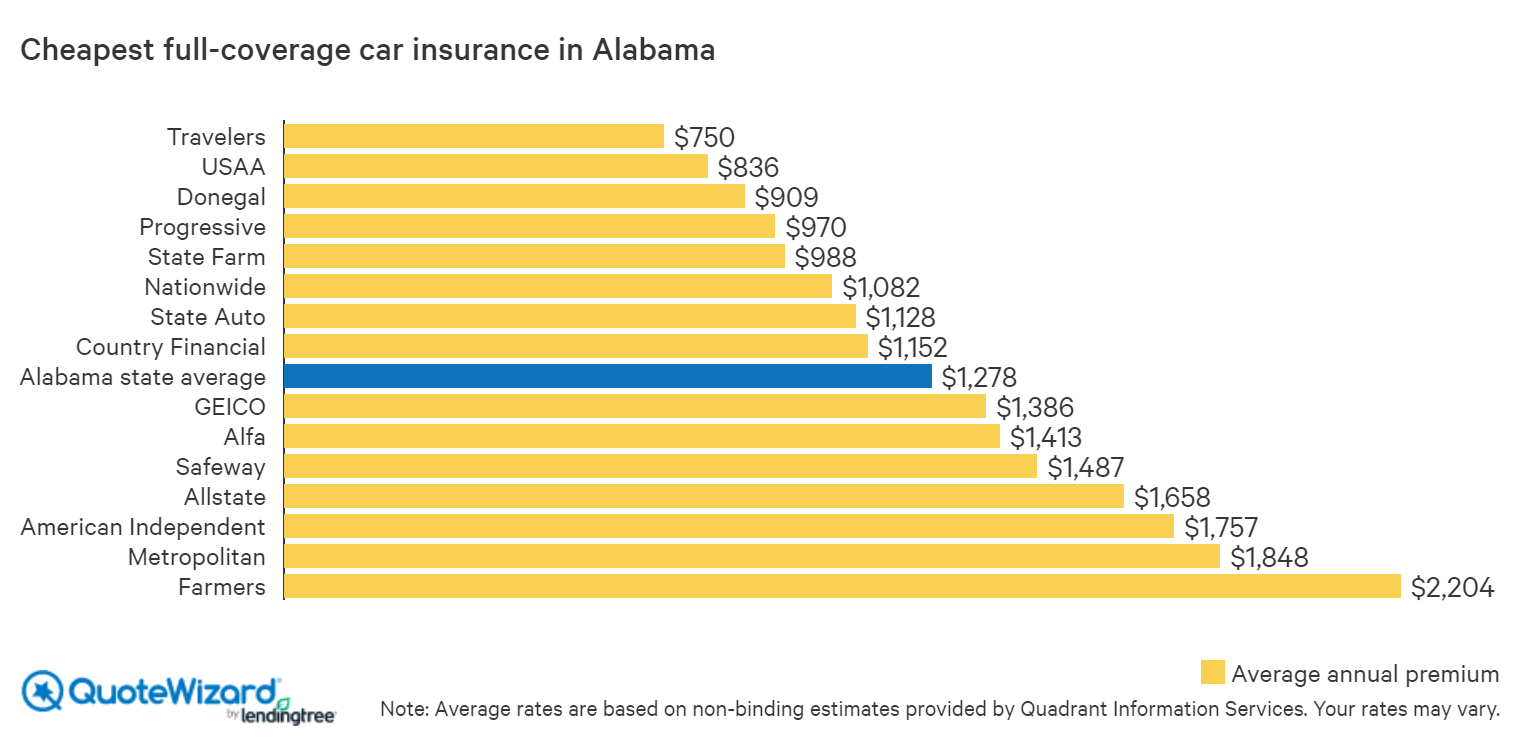

However, Erie isn't available to most homeowners, because the company only operates in 12 states. The exact amount that premiums go up after an accident depends on a few factors, including who was at fault, how much damage was caused, and the policyholder’s driving and claims history. In general, at-fault accidents or severe accidents that lead to expensive insurance claims increase rates more than minor or not-at-fault wrecks.

While State Farm’s basic HO-3 policy is generous, it doesn’t cover everything. (No basic plans we’ve found do.) But you can beef up your State Farm home insurance plan easily, and it’s surprisingly affordable. Maybe you’ve invested in an alarm system or a network of security cameras? That’s great, but have you considered your homeowners insurance? A comprehensive policy will help protect your biggest investment should disaster occur. However, rates vary significantly based on the state in which you live.

How much is homeowners insurance in California?

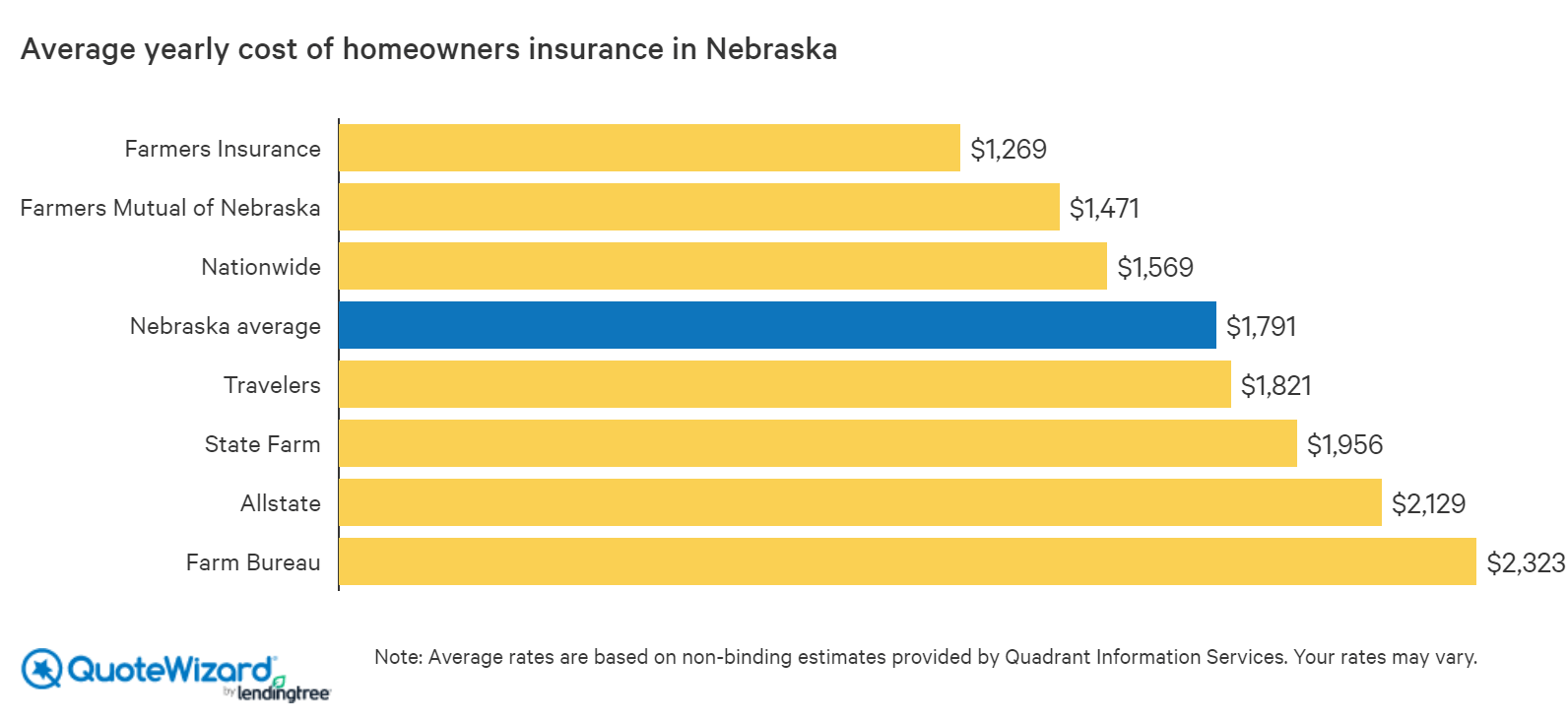

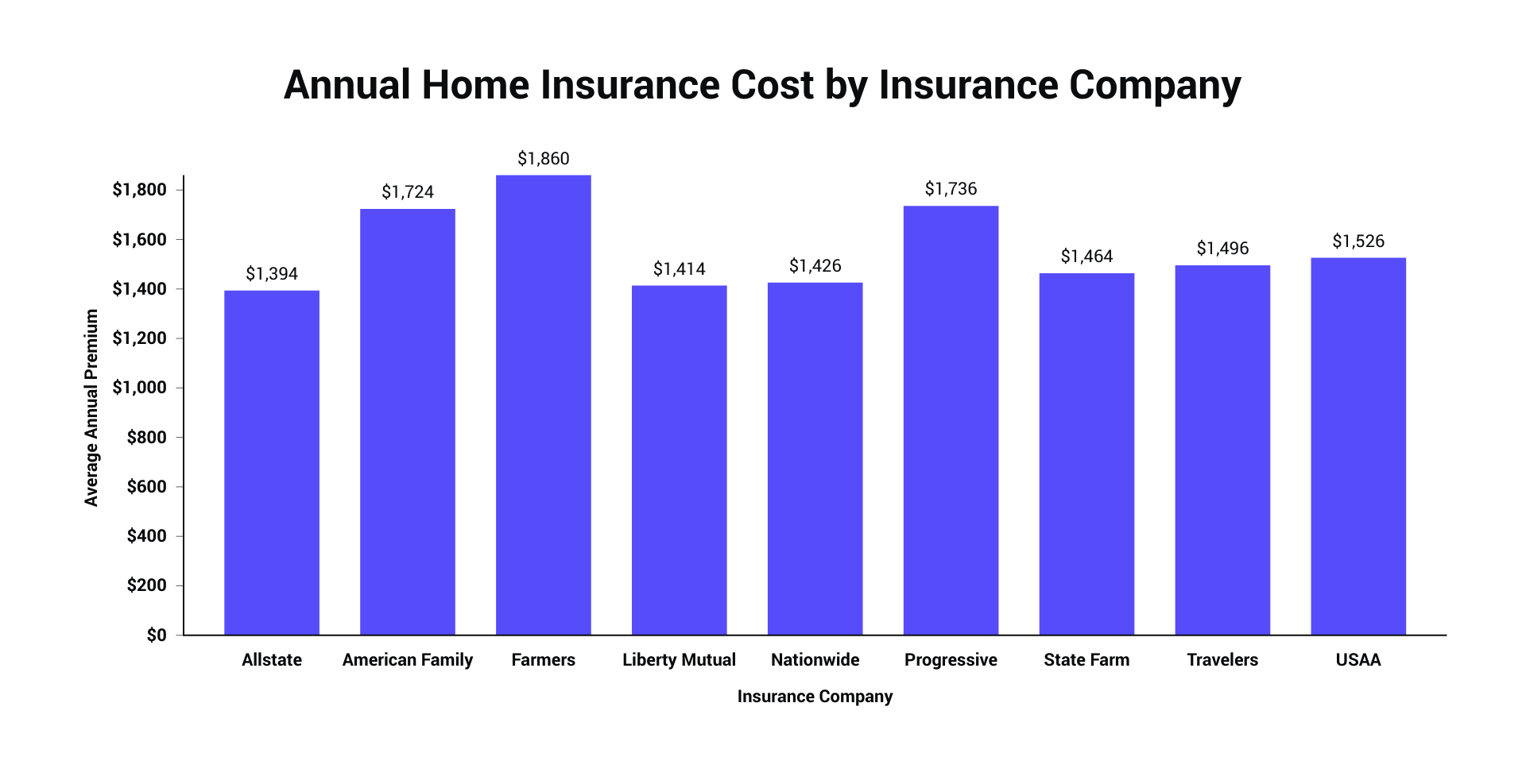

Make sure you request quotes for the same coverage limits so your comparison is accurate. You don't want to pay for a policy that seems like a great deal, only to later discover that you don't have enough coverage when you file a claim. Nationwide and State Farm offer affordable homeowners insurance policies nationally. Their rates are 35% and 20% cheaper than average, respectively. We compared quotes from a selection of companies to help you find home insurance that's not only affordable but also effective. For more information on how home insurance rates are determined, review some of the main factors affecting your home insurance rate.

The reason an insurer wants a home near a fire department and hydrant is that there is less chance of your home burning down if you live near a fire station. Having a hydrant nearby also means that firefighters can start battling a house fire faster than if the hydrant is down the street -- or even miles away. You should buy enough dwelling coverage to match the full replacement cost of your home. It's a good idea to get at least $300,000 of liability coverage to ensure sufficient coverage. For homeowners insurance with $300,000 in dwelling coverage, Oklahoma has the highest rate at $5,317 and Hawaii has the lowest rate at $582 based on a 2022 analysis by Insurance.com.

Otherwise, you might not be able to use the coverage that you have. Both State Farm and Allstate are rock-solid providers of car, life, and home insurance. If you’re on a budget, go with State Farm, but we rank Allstate slightly higher. While State Farm gives new policyholders the option to pay off their entire policy upfront with one payment , most drivers pay for their coverage monthly. Kansas is part of the “Tornado Alley” — an area where destructive tornados are more likely to occur. Kansas had 68 tornados in 2022 and was ranked fifth in the country for such windstorms by The National Oceanic and Atmospheric Administration’s Storm Prediction Center.

For your home insurance needs, Allstate’s mobile app contains a digital inventory of your home. The app makes it simple to seamlessly update and search through your insured items. James Shaffer is a writer for InsurancePanda.com and a well-seasoned auto insurance industry veteran. He has a deep knowledge of insurance rules and regulations and is passionate about helping drivers save money on auto insurance. He is responsible for researching and writing about anything auto insurance-related.

Each insurer rates these hazards differently, meaning they don't all increase premiums by the same amount. For that reason, the cheapest insurer nationally may not be the most affordable option where you live. Even in states where USAA wasn't the absolute cheapest option for homeowners, we felt that the company's superior customer service reputation more than made up for that fact. Its affordable rates for auto insurance, combined with its solid bundling discount, could help shoppers significantly reduce their premiums. Erie offers the cheapest home insurance rates — a policy costs $883 per year or $76 per month, which is 53% less expensive than the national average.

At a dwelling coverage of $200,000, the average rate is $2,233, while a policy with $500,000 in dwelling coverage averages $3,594. Both Allstate and State Farm offer a wide range of coverage levels, but Allstate has more options. In addition, you can customize deductible and personal property coverage limits. Take a close look at which of these can apply to your home and choose which would be more useful. If you buy full coverage car insurance with State Farm, then you can expect to pay an average of around $1,436 per year, which is close to the nationwide average.

Traffic school in order to remove a violation or points from your record, depending on your state. State Farm even offers a 10-15% discount to drivers who take an approved defensive driving course. State Farm logs fewer complaints on WalletHub, and they consistently rank high on J.D Power customer service surveys. The caveat is that State Farm largely relies on independent agents and call centers to field calls, so very remote areas might have trouble finding local representatives for claims.

No comments:

Post a Comment