Table of Content

The interest rates are generally available per an individual’s CIBIL score and profile. Moreover, there are provisions for customers to choose from fixed or variable interest rates. The floating interest rate scheme is currently being offered at 8.55%. Moreover, loan rates are attractive and personalised for its customers as per their eligibility. There are various means by which a customer can get in touch with a bank representative to get their queries sorted. SBI home loan borrowers can contact SBI customer care through toll-free contact numbers and email addresses or visit the nearest bank branch.

This consent will override any registration for DND/NDNC/NCPR. Explore your dream house from a bouquet of exclusive products designed for each customer segment. SBI welcomes you to explore the world of premier banking in India. Our commitment to nation-building is complete & comprehensive. SBI Home Loans come to you on the solid foundation of trust and transparency built in the tradition of SBI.

Eligibility Criteria of State Bank Of India Account Home Loan

This is a quick and convenient way for SBI customers to obtain the necessary information they require, without leaving the comfort of their home. Other than that, customers will be required to submit essential papers pertaining to their property. These should include a no-objection certificate from the project owner/builder, a sale agreement deed, stamp duty, a maintenance bill, and other related documents that are required to be submitted. SBI home loans come with an array of features and benefits that makes them a lucrative financial product to opt for.

Check the list of SBI home loan documents required to get your dream loan. With property rates increasing manifold and miscellaneous expenses taking a toll on savings, home loans offered by financial institutions pose as a strong pillar of support. Thus, while almost all banks offer attractive home loans to the public, it is recommended to choose one smartly and by careful comparison. In all, the credibility, goodwill, and reputed service of SBI make it one of the most recommended financial institutions of the country when it comes to applying for a home loan. Their flexible offerings for customers of all strata of the society coupled with no additional charges or hidden fees are designed to ensure the comfort of their clients.

Government Schemes

Financially, it makes sense to purchase a property through home loan rather than through personal financing especially when you can invest your personal funds somewhere else for better returns. By clicking "Proceed" button, you will be redirected from SBI website to the resources located on servers maintained and operated by third parties. SBI doesn't take any responsibility for the images, pictures, plan, layout, size, cost, materials or any other contents in the said site.

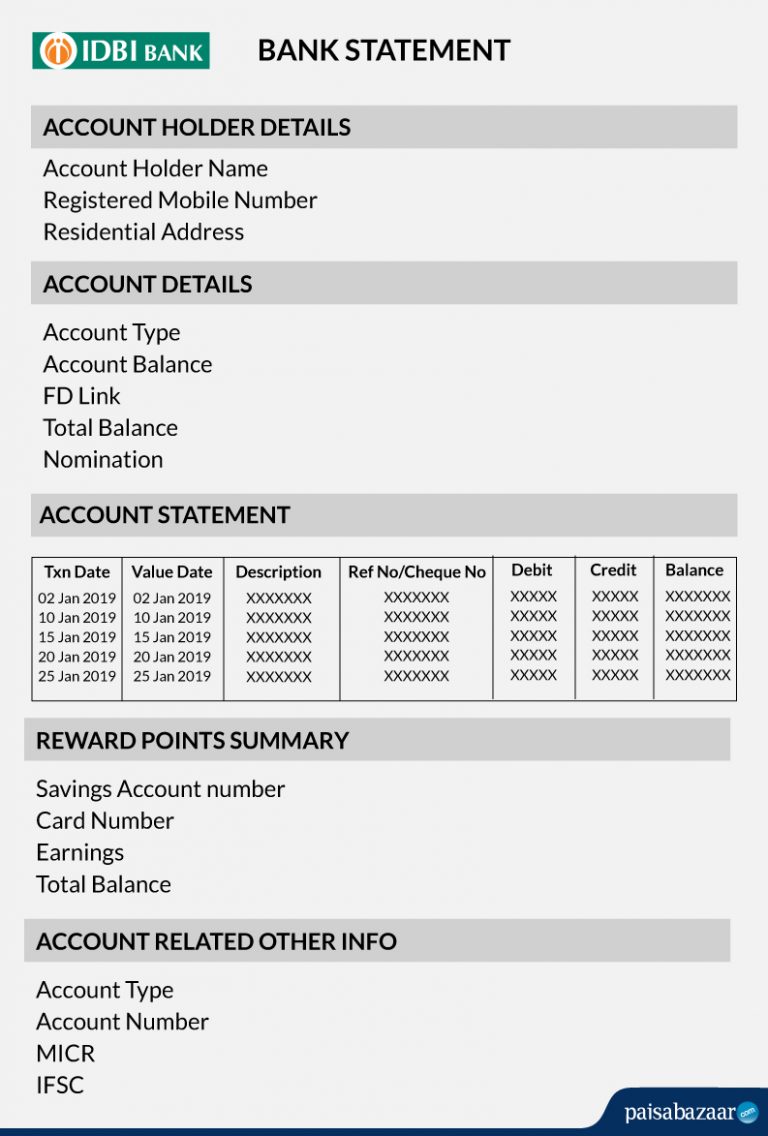

Profit and loss statement that is accredited by a chartered accountant. There has been seldom such a dynamic phase for Home Loan customers as the last few month... Account statement or payment receipt showing all the payments made by the applicant to the builder.

Home Loan Documents Required State Bank Of India

Attractive interest rates along with affordable processing fees. Last six months’ Bank Statement of overseas account in the name of individual as well as company/unit. Banks will provides you an home loan if you are eligible for home loan. Banks required below listed documents when you apply for home loan.

The list of SBI home loan documents varies for existing and new customers. Also, salaried and self-employed individuals submit different income proofs. Existing customers get the advantage of no-paperwork approvals with a simplified documentation process.

This allows you to get all the benefits of the home loans offered by SBI including competitive interest rates. State Bank of India home loan documents comprise Home loan application form, most important terms and conditions, and PMAY-Annexure – B form. The State Bank of India offers customers an online portal through which they can acquire their home loan statements or interest certificates.

Should have valid Aadhaar Card, Pan Card, Professional degree certificate, shop and business establishment certificates etc. Should have valid Aadhaar Card, Pan Card, shop and business establishment certificates etc. Kindly download, sign and upload the duly signed consent form along with the KYC documents in the "Upload Application & Document for Preliminary Verification" link. For a better and safer user experience, please upgrade your browser.

This is subject to change based on the eligibility criteria of the individual. We have a network of + branches, sales teams and processing centers across the country to cater to the housing loan requirements of individual customers. Please click here to locate us and contact us for your home loan requirements. Please locate us and contact us for your home loan requirements. If you want to download home loan application form, you need to go to theofficial website of SBI.

Log in to yonobusiness.sbi to avail business banking services. Moreover, there is a provision for customers to opt for an overdraft facility and concession for women borrowers. It is always prudent to consider shopping around for the best deals banks offer. Given that many financial institutions are providing home loan products, there are always chances that one might land a better deal than the other owing to competitive market conditions. The SBI Home Loan comes with an interest rate starting from 8.50%, and other top banks offer much lesser rates. SBI offers its customers Home Loan interest rates based on the CIBIL score of each individual.

On the homepage, you will find “Application Tracker” on the right side. If you want to download PMAY-Annexure-B form, you need to go to official website of homeloans SBI. Apart from this there are home loan takeover calculator, maxgain home loan calculator, flexipay home loan calculator, and privilege or shaurya Home Loan calculator.

It includes options for purchase of ready built property, purchase of under construction property, purchase of pre-owned homes, construction of a house, extension of house and repair/renovation. Copy of Form 16 for the last two years or a copy of IT returns for the last two financial years, acknowledged by the Income Tax Department. You are just one step away from using Home Loan related services. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans. Please get answers to your common queries regarding the home loan, security, EMIs, etc.

Proof of income in case of self-employed professionals/businessmen. Offices or Indian Embassy/Consulate or Overseas Notary Public or officials of Branch/Sourcing outfits based in India. Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years, acknowledged by IT Dept. "THE MOST PREFERRED HOME LOAN PROVIDER" voted in AWAAZ Consumer Awards along with the MOST PREFERRED BANK AWARD in a survey conducted by TV 18 in association with AC Nielsen-ORG Marg in 21 cities across India.

No comments:

Post a Comment